Vancouver, B.C. April 15, 2020 — Ascot Resources Ltd. (TSX: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce robust results for an independent Feasibility Study (the “Study”) prepared in accordance with a National Instrument 43-101 Technical Report (“NI 43-101”) for its 100% owned Premier and Red Mountain gold projects (the "Project") located in the Golden Triangle near Stewart, British Columbia, Canada. The Study outlines a low capital restart plan to feed the Premier mill at 2500 tonnes per day (“tpd”) to produce approximately 1.1 million ounces (“Moz”) of gold and 3.0Moz of silver over eight years. The Study is based on a proven and probable reserve (noted below) of 6.2 million tonnes (“Mt”) from the Project. In addition to the reserves, the Company has inferred resources of 5.1Mt at 7.25 grams per tonne (“g/t”) gold at Premier, with approximately 2.2Mt of this resource material at similar grade, near the planned development, which may potentially be converted to reserves during operations.

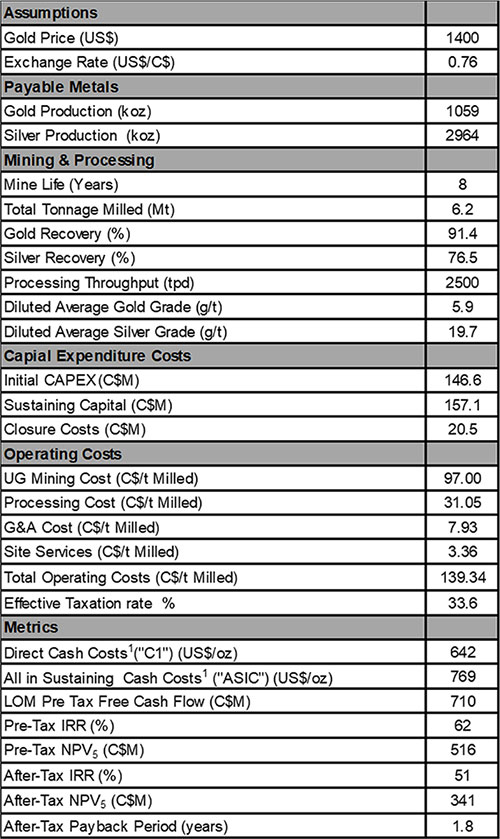

Feasibility Study Highlights:

Base case assumptions are using a US$1400/oz gold price, $17/oz silver price and CAD to US exchange rate of 0.76. All values shown in Canadian dollars unless otherwise noted. Some figures may not add due to rounding

- Base case Pre-Tax Net Present Value (“NPV”) NPV5% of $516M, internal rate of return (“IRR”) IRR of 62%;

- Base case After-tax NPV5% of $341M and IRR 51%, and after-tax payback period of 1.8 years;

- Assuming a spot gold price of US$1710 per ounce and spot CAD to US exchange rate of 0.71, the project economics increase to an After-tax NPV5% of $602M and IRR 78%;

- The base case utilizes Proven and Probable Reserves of 6.2Mt at 5.9g/t gold and 19.7g/t silver; this includes the impact of the mining dilution and excludes all resources outside of planned stopes

- Low initial capital expenditure of $147M, including a 9% contingency, and 22% indirect costs;

- Life of Mine (“LOM”) payable production of 1.1Moz of gold and 3.0Moz of silver with peak production of 180 thousand gold equivalent ounces;

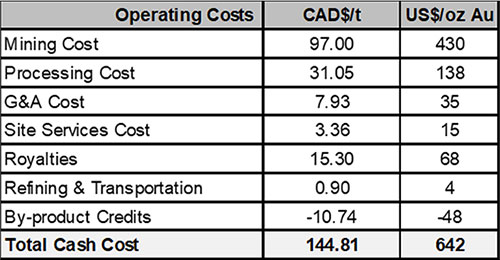

- LOM operating costs (“C1”)* of $145 per tonne processed or US$642 per payable ounce produced and LOM all in sustaining costs (“AISC”)* of $174 per tonne processed or US$769 per payable ounce produced.

* C1 and AISC are Non-GAAP and IFRS measure see note 1 of Table 1

Ascot’s President and CEO, Derek White commented, “The completion of the Feasibility Study marks an important milestone for Ascot in the progression of restarting the Project. The current strong gold price environment, robust projected economics and quick payback creates an attractive opportunity to build our mine. The Study focused on maximising the project economics, which involved optimising mining methods and development to reduce operating cost per ounce. The result of this optimisation was a conversion of 64% of indicated resources to reserves at Premier. Management believes that future underground drilling will help to improve conversion of some of the remaining inferred resources and improve annual production rates. Management’s next steps will be focused on advancing this exceptional gold project with all our stakeholders while continuing to grow our mineral resources and reserves to enhance value through further drilling and delivering a number of identified opportunities.”

Potential value enhancement opportunities identified beyond the scope of the study:

- Reduced mining dilution and development capital by optimizing shallow angle mining;

- Conversion of approximately 2.2Mt of resources in the Inferred Category;

- Reduced process capital and operating cost by introducing process enhancements.

Feasibility Overview

The Premier Gold Project (“PGP”) is located 25 kilometres (“km”) north of the town of Stewart, British Columbia, adjacent to the border with Alaska in the famous gold mining district known as the Golden Triangle. The PGP can be accessed by road from Stewart and does not require a remote campsite for employees. Three of the deposits are based at PGP and the fourth deposit is located at the Red Mountain Project (“RMP”), situated approximately 23km to the southeast of the PGP mill. PGP requires amendments to the Mines Act and Environmental Management Act permits and is a brownfield site; it does not require an Environmental Assessment. RMP has federal ministerial approval and provincial environmental assessment certificates, but will require multiple permits and potential amendments, including a Mines Act permit and an Environmental Management Act permit.

The Study is based on four underground mining operations feeding a centralized 2500 tpd processing facility, located at PGP. The four mining operations known as Silver Coin, Big Missouri, Premier and Red Mountain will be sequenced over an 8-year period to initially produce 1.1 Moz. of gold and 3.0 Moz. of silver. PGP benefits from existing road access, historical mining, milling, the nearby Long Lake Hydro power plant, tailings and mine waste stockpile infrastructure resulting in a low initial capital refurbishment cost. Mining will commence from the Silver Coin and Big Missouri deposits, which will be followed by the Red Mountain deposit in year 3 and then the Premier deposit. In the four planned operations, access for production will be through both new and existing adits (side hill portal access) utilizing a combination of new ramp development and refurbishment of existing underground infrastructure. Mining methods will largely consist of low-cost long hole stoping for most of the ore, with limited use of inclined undercut long hole, room & pillar and cut & fill mining methods in specific shallow or flat lying stopes. Ore will be trucked to the processing facility and mining waste will be used underground as a combination of rockfill and cemented rockfill.

The existing processing facility will be refurbished within a construction period of approximately 40 weeks. The process plant will utilize conventional crushing, grinding and gravity circuits followed by a standard carbon-in-leach (“CIL”) process to produce a gold doré. The plant refurbishment will consist of a combination of existing, new and repaired equipment and supporting plant infrastructure. Prior to ore from RMP being treated, the plant will add an energy efficient fine grinding mill and an additional pre-leach thickener to accommodate processing of the harder ore feed and the finer grind required for recovery purposes.

PGP has an existing tailings storage facility and water treatment plant, and is adjacent to the Long Lake Hydro power plant, which currently supplies Pretium’s Brucejack Mine and connects to the BC Hydro grid. Currently, the site receives power via a 25-kiloVolt power line from the town of Stewart. This arrangement would be modified with a new substation to be constructed adjacent to the processing plant that would receive power from the Long Lake power plant approximately 800 metres south of the processing plant. Power would be distributed to the site from this substation. The Study has two key enhancements to the existing infrastructure: the tailings dam would be successively raised using centreline lifts throughout the mine life with approximately 1.2 million cubic metres (“m3“) of non-acid generating rock excavated from a nearby quarry; and the water treatment plant would be modified to nearly double the existing capacity to accommodate additional water treatment from the Big Missouri and Silver Coin operations, and would also include an ammonia treatment plant, a water clarifier and lime high density sludge system.

In order to complete this study, Ascot engaged a team of highly experienced professional consultants led by Sacre-Davey Engineering Inc. (“SDE”). SDE was responsible for overall coordination, infrastructure and the economic evaluation; InnovExplo Inc. and Mine Paste Ltd. for mining; Sedgman Canada Limited (a member of CIMIC Group) for metallurgy and processing; Knight Piésold Ltd. for tailings and water management; SRK Consulting (Canada) Inc. for the water treatment plant; Paul Hughes Consulting Ltd. for site geotechnical; McElhanney Ltd. for access roads; Prime Engineering for the Electrical substation; Palmer Environmental Consulting Group Inc. for geochemistry, hydrology and water quality modelling; and Falkirk Environmental Consultants and EcoLogic Consultants for environmental studies.

Table 1: Life of Mine Summary

- C1 includes mining processing, site services, G&A, refining & transportation cost and royalty cost less by-product credits. AISC includes C1 cost plus sustaining capital. C1 and AISC costs are non-GAAP performance measures;

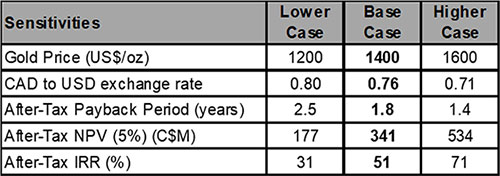

Sensitivities

After-tax economic sensitivities are presented in Table 2 illustrating the effects of varying precious metals prices and exchange rates to LOM base-case. Additional project sensitivities will be presented in the Technical Report.

Table 2: After-Tax NPV (5%) and IRR Sensitivities to Gold Prices & Exchanges rate

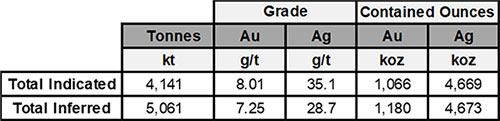

Mineral Resource Estimate

The Company’s Mineral Resources at the PGP noted in Table 3 and for RMP in Table 4 are combined to form the basis of the mineral reserves in this Study. The QP for the resource estimation work for RMP was completed by independent* consultant Dr. Gilles Arseneau, P.Geo (APEGBC) with an effective date of the Mineral Resource Statement of August 30, 2019. The QP for the resource estimation work at PGP was completed by independent* consultant Susan Bird, P.Eng (APEGBC) with an effective date of the Mineral Resource Statement of December 12, 2019.

* Independent ‘qualified persons’ within the meaning of NI 43-101

Table 3: PGP Mineral Resource Statement reported at 3.5g/t AuEq cut-off

Notes for Table 3:

- Mineral Resources are estimated at a cut-off grade of 3.5g/t AuEq based on metal prices of US$1,300/oz Au and US$20/oz Ag.

- The AuEq values were calculated using US$1,300/oz Au, US$20/oz Ag, a silver metallurgical recovery of 45.2%, and the following equation: AuEq(g/t) = Au(g/t) + 45.2% x Ag(g/t) x 20 / 1,300.

- A mean bulk density of 2.85 t/m3 is used for Premier and of 2.80t/m3 for all other deposit areas.

- A minimum mining width of 2.5m true thickness is required in order to be classified as Resource material.

Mineral Resources are inclusive of Mineral Reserves declared below. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. The CIM definitions were followed for the classification of Indicated and Inferred Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated Mineral Resource category.

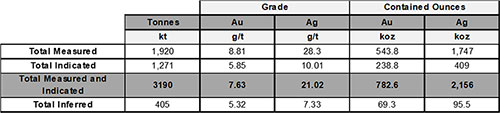

Table 4: RMP Mineral Resource Statement reported at 3.0g/t Au cut-off

Notes for Table 4:

- RMP Resources are reported at a 3.0g/t Au cut-off for underground long hole stoping.

- Reported Mineral Resources are inclusive of Mineral Reserves declared below. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. The CIM definitions were followed for the classification of Indicated and Inferred Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated Mineral Resource category.

Mining and Mineral Reserves

The mineral resources were determined using conservative cut-off grade estimates and incorporating mining thicknesses into wireframing and converted to reserves, by applying mining economics to the resources, including allowing for recovery and dilution underground. As part of the mine planning exercise, the indicated mineral resource was run through the Deswik Stope Optimizer and evaluated under a number of different mining methods.

The Study’s mine plan generally utilizes a combination of three mining methods: longhole (64%), inclined undercut longhole (14%), and room & pillar (12%), with minor amounts of cut and fill (2%) and development ore (8%) to extract the mineral reserves. A particular mining method was chosen based on an economic assessment of each method for a given geometry and geotechnical characteristics depending on its location in the deposit. The stope shapes and mine access development were individually modelled and evaluated to form the final mineable reserve. Mining dilution occurs at various rates depending on the mining method and ground conditions based on rock quality in geotechnical domains in the block model. Dilution comes in from a number of sources: planned dilution is material taken within the bounds of a stope layout while unplanned material comes from the hanging wall and footwall outside the stope boundary. Dilution generally ranges from 10 to 40%. In some cases where two wireframes are very close together, the waste parting between the wireframes was taken provided that it was economically justified. The over-arching philosophy was to maximize the extraction of resource ounces at the lowest cost per ounce.

Initial mining commences at Silver Coin (1.794Mt) and Big Missouri (0.809Mt), followed by RMP (2.545Mt) and Premier (1.028Mt). This sequencing allows mobile mining equipment and some fixed assets (electrical and ventilation) to most effectively be remobilized and re-used at different deposits as dictated by mine schedules. The Study assumes a lease to own cost for the mobile mining equipment, which primarily consists of the following key pieces of equipment: 2 scissor lifts,3 jumbo drills, 5 haul trucks, 5 load-haul-dump machines, 15 ventilation fans, and several other smaller supporting pieces of equipment.

The mineral reserve figures are shown below in tables 5 and 6. The QP for the mineral reserve estimation work for the Project is the independent* consultant Frank Palkovits, P.Eng.

* Independent ‘qualified persons’ within the meaning of NI 43-101

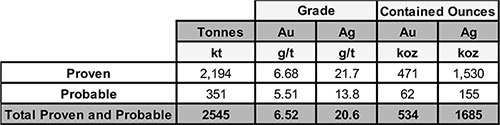

Table 5: PGP Mineral Reserve Statement

Notes for Table 5: CIM Definition Standards were followed for classification of Mineral Reserves

- A mean bulk density of 2.85 t/m3 is used for Premier and of 2.80 t/m3 for all other deposit areas

- The AuEq values were calculated using US$1,400/oz Au and a US$17/oz Ag and the following equation: AuEq(g/t) = Au(g/t)+ Ag(g/t) x 17 / 1,400

- The following CoG based on AuEq grade were used to estimate the economic potential of the stopes: Longhole = 2.85 g/t, Inclined undercut Longhole = 3.44 g/t, cut and fill = 3.44 g/t, room & pillar = 3.82 g/t and development = 2.85 g/t

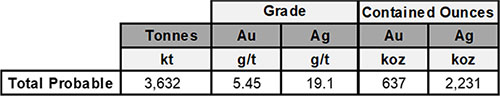

Table 6: RMP Mineral Reserve Statement

Notes for Table 6 CIM Definition Standards were followed for classification of Mineral Reserves

- The AuEq values were calculated using US$1,300/oz Au and a US$15/oz Ag and the following equation: AuEq(g/t) = Au(g/t) + Ag(g/t) x 15 / 1,300

- The following CoG based on AuEq grade were used to estimate the economic potential of the stopes: Longhole = 3.11 g/t, Inclined undercut Longhole = 4.0 g/t, cut and fill = 4.1 g/t and development = 3.11 g/t

Metallurgical & Processing Overview

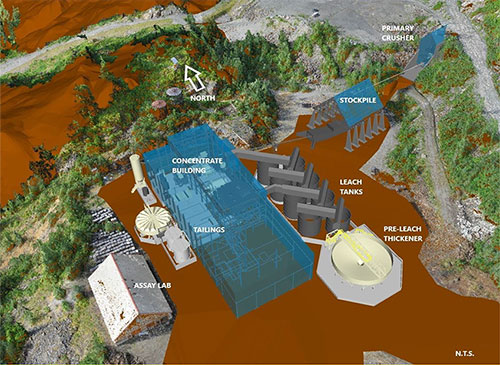

An overview schematic of the processing facilities, with both existing infrastructure (in blue) and new construction (in yellow) is shown below:

Figure 1: Premier Plant Area

During 2019, an engineering assessment was conducted by CGT Industrial on the existing processing facility to establish its working condition and provide the basis for the recently completed Study.

The existing plant arrangement is suitable for a semi autogenous grinding (“SAG”) and ball milling flowsheet followed by the refurbished carbon-in-leach circuit. Over the mine life, the plant will operate 365 days a year to produce gold doré with an overall plant availability of 92% and an average throughput of 2500 tpd. In the latter part of year three, ore from RMP will be introduced to the existing mill facility.

Ore will be fed from either one of the PGP or the RMP stockpiles using a campaigning methodology. Ore from PGP will be primary crushed, stockpiled and fed into the existing SAG and Ball Milling arrangement to be ground to a particle size (“P80”) of 80 microns (“µm”). An integrated gravity circuit will remove coarse gold for cyanidation in the intensive leach reactor (“ILR”) with the remainder to be cyanide leached in a conventional CIL circuit. Gold will be recovered on carbon, eluted and then electro-won to produce a silver/gold doré. Gold recovered from the ILR will be electro-won separately to produce a separate gold doré.

Leached tails will be detoxified in an Air and Sulphur Dioxide cyanide destruction circuit, then thickened and pumped to a tailings storage facility (“TSF”). Raw water required for fresh water make-up is pumped to the plant from Cascade Creek whilst process water is recovered from the TSF decant water, which will be used for grinding and utility water.

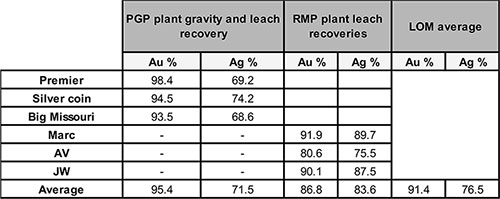

For the processing of the RMP ores, the initial circuit flow sheet will be adapted in the latter part of year two of production. Gravity recoverable gold is absent from the RMP ore; therefore, the gravity circuit will be bypassed whilst processing this ore. The RMP gold and silver recovery is sensitive to grind size, and as such a P80 target of 25µm is required to optimize precious metals recoveries in the leaching circuit. In order to achieve the targeted fine grind, a tertiary/fine stirred mill will be installed in the plant. The grinding circuit product will require thickening prior to introduction to the CIL circuit. Based on the current and historical test work, a 27-meter diameter pre-leach thickener will be required for this application. When PGP ores are campaigned, the fine grinding circuit will be bypassed. Estimated gold and silver recoveries used for the design of the processing facilities are shown in Table 7 below.

Table 7: Recovery by Deposit

Tailings and Water Management

Tailings will be managed in the existing Tailings Storage Facility (“TSF”) that will be progressively raised to store 100% of the tailings during the design operating life. Knight Piésold is the Engineer of Record for the TSF. Upgrades to the TSF include modification of water management structures, additional material added to the embankment to flatten the slopes to meet current codes, and installation of new tailings distribution and reclaim water systems.

Non-contact water diversion structures located upstream of the TSF will be upgraded to minimize flood routing through the TSF. Site surplus water and underground dewatering will be directed to the new water treatment plant for treatment as required prior to release.

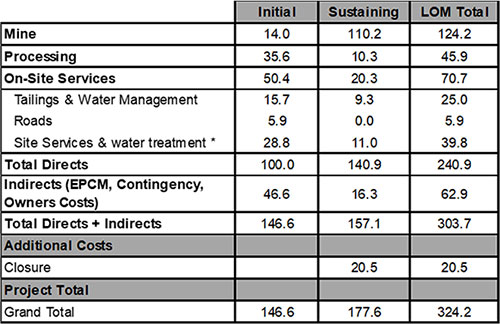

Capital Costs

The Project benefits from significant existing infrastructure, which helps reduce the initial capital cost. Total initial pre-production capital cost (capex) is C$146.6M inclusive of construction indirect costs, engineering-procurement-construction- management (“EPCM”), contingencies and owners’ costs. The mobile equipment is leased and these costs have been included in the operating costs. The sustaining capital is C$157.3M inclusive of mine development capital, road construction to RMP, and process plant modifications for the fine grind and additional pre-leach thickener. The total life of mine capex is C$324M inclusive of closure costs. Underground mining and haulage are anticipated to be completed using an owner-operator development model operating 365 days per year. Table 8 shows the capital cost breakdown.

Table 8: Project Capital Cost Estimate (C$M)

* includes the RMP road

Operating Costs

Life of mine operating costs for the project were developed from first principles for mining, processing, site services and administration using the mine and processing plans, incorporating development rates, labour, materials, consumables, and certain contract services for a 2500 tpd processing rate. Processing cost in year 3 increases by $4.25 per tonne processed due the higher grinding requirements for harder ore from RMP. Table 9 shows the breakdown of LOM operating costs.

Table 9: Project LOM Operating Costs (C$/t milled)

Permitting Process

PGP is currently in care and maintenance with existing permits for continued reclamation and mine water discharge. The site has been maintained in good standing with reclamation activities and environmental monitoring ongoing. In 2018 and 2019, Ascot undertook additional environmental baseline monitoring and data collection to support permit amendments for the Mine’s Act and the Environmental Management Act, and several ancillary permits, which will be required to bring PGP back into operation. In 2018, Ascot received confirmation from both the BC Environmental Assessment Agency and the Canadian Environmental Assessment Agency that PGP will not need to undergo an environmental assessment pursuant to provincial and federal environmental assessment legislation. Nisga’a Lisims Government (NLG) confirmed that an assessment of the impacts of the proposed PGP and amendments to the proposed RMP on Nisga’a Nation treaty interests will need to be conducted pursuant to the Nisga’a Final Agreement.

In 2019, RMP received federal approval and issuance of a provincial Environmental Assessment Certificate (“EAC”). The decision also included a determination of the potential effects of the Nisga’a Final Agreement (2000). RMP will next require issuance of the necessary statutory permits and authorizations to commence construction of the project. Any changes to the project description, resulting from coupling activities or toll milling with PGP, will first require an amendment to the RMP EAC before proceeding to detailed design and ensuing permit applications.

Aboriginal and Community Stakeholders

PGP is located in the Nass Area and RMP is located in the Nass Wildlife Area, as defined in the Nisga’a Final Agreement (2000), a modern treaty between the federal government, provincial government, and Nisga’a Nation, which sets out Nisga’a Nation’s rights under Section 35 of the Canadian Constitution Act. Nisga’a Nation’s Treaty rights under the Nisga’a Final Agreement include: establishing the boundaries and the Nisga’a Nation’s ownership of Nisga’a Lands and Nisga’a Fee Simple Lands; water allocations; the right of Nisga’a citizens to harvest fish, wildlife, plants and migratory birds; and the legislative jurisdiction of the NLG. Nisga’a citizens have Treaty rights to manage and harvest wildlife in the Nass Wildlife Area and to harvest fish, aquatic plants, and migratory birds within the Nass Area. The clarity and certainty provided by the Nisga’a Final Agreement, including Chapter 10, which sets out the required processes for the assessment of environmental effects on Nisga’a Nation Treaty rights from projects such as this one, is a major advantage to development.

The nearest communities to RMP and PGP are the town of Stewart, British Columbia and the village of Hyder, Alaska. Both communities have a long-standing history with mining projects and have historically been supportive of mining activities. Broader stakeholders may include overlapping tenure holders (such as trapline holders, guide outfitters, and independent power producers), local and regional governments, and government regulatory agencies.

Ascot is committed to meaningful, timely and transparent engagement and consultation with the NLG, community members, stakeholders and the public. Ascot will maintain this commitment throughout the proposed development, construction, operation and closure of the Project.

Project Opportunities and Value Enhancements

The Study focused on existing indicated mineral resources and utilized proven conventional mining and processing methods. The Study did not consider potential alternatives or additional resources to improve value. During the course of study, a number of value enhancements to the project were identified, including:

- Reducing mining dilution and development by undertaking further studies and testing of an emerging mining method called the shallow angle mining system (“SAMS”) which is currently being tested by its developer Minrail at Eldorado Gold Corporation’s Lamaque Mine in Val D’or Quebec. SAMS is similar to Alimak mining but at a low angle, with a central drive and long holes drilling laterally, offering the potential to significantly reduce dilution, operating costs and mine capital development costs;

- Conversion of inferred resources that could extend the mine life and increase throughput rates. The resource inventory of the Premier, Silver Coin and Big Missouri deposits currently contains 4.173Mt in the Inferred Category. Approximately 2.2Mt of inferred resources (approximately 53%) are located within 100 metres of existing or planned underground development. The Company will focus on converting these resources to the Indicated Category and make them available for conversion to reserves in future mine plans;

- Completion of testwork opportunities to further optimize the reagent consumption rates over the processing cycle which could reduce processing costs;

- Completion of value enhancement studies that will potentially lower the capital and operating costs particularly for the RMP ore that will be introduced in approximately year 3 of production.

Recommendations and Next Steps

Given the positive economics of the Project and potential for further value enhancements to the Project economics, the Company will continue to advance the Project towards development. Ascot will seek funding from capital sources for the construction and development of the Project over the coming months. In addition, the Company will do the following activities:

- Continue working with NLG and Provincial regulators to promote a cooperative and mutually respectful relationship to advance the permit amendment applications for PGP;

- Continue with the optimization of the project execution and construction schedule, including procurement and permitting;

- Commencement of further detailed engineering and design activities to investigate value enhancements to the project noted above;

- Continue additional drilling to advance the discovery and conversion of additional resources on the project sites.

Qualified Persons and NI 43-101 Disclosure

John Kiernan, P.Eng., Chief Operating Officer of the Company is the Company’s Qualified Person (QP) as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this news release.

The NI 43-101 Feasibility Study Technical Report is being prepared in accordance with NI 43-101 and will be filed under the Company’s profile on SEDAR within 45 days of this press release. The Qualified Persons have reviewed and verified that the technical information in respect to the Feasibility Study in this press release is accurate and approve the written disclosure of such information.

The Qualified Persons who will prepare the Technical Report are:

Company Webcast & Conference Call

Ascot will be hosting a webcast and teleconference on April 16th at 1:15 pm PT/4:15 pm ET. Ascot’s CEO, Derek White will be available to answer questions at the end of the call.

The webcast can be accessed through the Investor page of Ascot’s web site or by clicking on the following link: http://services.choruscall.ca/links/ascot20200415.html. The live call may be accessed by dialing 1-800-319-4610 for North American callers, or 1-604-638-5340 for International callers. Callers should dial in five to ten minutes prior to the scheduled start time, and ask to join the “Ascot Resources Conference Call.” The webcast will be available on demand at the same link for 3 months following the live event.

We look forward to providing you with a more comprehensive update at that time, including discussing the results of the Feasibility Study. In the meantime, if you have any questions, please do not hesitate to email Kristina Howe, our VP of Investor Relations.

ON BEHALF OF THE BOARD OF DIRECTORS OF

ASCOT RESOURCES LTD.

“Derek C. White”, President and CEO

For further information contact:

Kristina Howe

VP, Investor Relations

778-725-1060 / khowe@ascotgold.com

About Ascot Resources Ltd.

Ascot is a Canadian-based exploration and development company focused on re-starting the past producing historic Premier gold mine, located in British Columbia's Golden Triangle. The Company continues to define high-grade resources for underground mining with the near-term goal of converting the underground resources into reserves, while continuing to explore nearby targets on its Premier/Dilworth and Silver Coin properties (collectively referred to as the Premier Gold Project). Ascot's acquisition of IDM Mining added the high-grade gold and silver Red Mountain Project to its portfolio and positions the Company as a leading consolidator of high-quality assets in the Golden Triangle.

For more information about the Company, please refer to the Company’s profile on SEDAR at www.sedar.com or visit the Company’s web site at www.ascotgold.com, or for a virtual tour visit www.vrify.com under Ascot Resources.

The TSX Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements, trend analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein are forward-looking statements, including statements in respect of the closing of the Private Placement and the use of proceeds. Although Ascot believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Ascot can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Ascot’s periodic filings with Canadian securities regulators, and assumptions made with regard to: the estimated costs associated with construction of the Project; the timing of the anticipated start of production at the Projects; the ability to maintain throughput and production levels at the Premier Mill; the tax rate applicable to the Company; future commodity prices; the grade of Resources and Reserves; the ability of the Company to convert inferred resources to other categories; the ability of the Company to reduce mining dilution; the ability to reduce capital costs. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Ascot’s expectations include risks associated with the business of Ascot; risks related to exploration and potential development of Ascot’s projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and indigenous groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; risks associated with COVID-19 including adverse impacts on the world economy, construction timing and the availability of personnel; and other risk factors as detailed from time to time and additional risks identified in Ascot’s filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). The timing of future economic studies; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of Project as well as those factors discussed in the Annual Information Form of the Company dated March 13, 2020 in the section entitled "Risk Factors", under Ascot’s SEDAR profile at www.sedar.com. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Ascot does not undertake any obligation to update forward-looking statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration; however, there is no certainty that these inferred mineral resources will be converted into mineral reserves, once economic considerations are applied. The mineral resource estimates referenced in this release use the terms "Indicated Mineral Resources" and "Inferred Mineral Resources". While these terms are defined in and required by Canadian regulations (under NI 43-101), these terms are not recognized by the U.S. Securities and Exchange Commission ("SEC"). "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Ascot is not an SEC registered company.